Tax Audit

Fiscal Year vs Financial Year

|

The terms Fiscal Year and Financial Year are synonymous, i.e. meaning the same thing. They are a period that governments use for accounting and budget purposes. However, they are also the duration on which tax... |

PAN Card vs AADHAR Card

|

PAN stands for Permanent Account Number. It is a number that is issued to any person who pays tax. Aadhar is an UID, i.e. a unique identification number. Its main purpose is to create a database of each... |

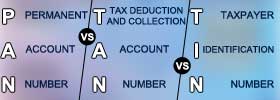

PAN vs TAN vs TIN

|

A PAN number is a number for anyone who pays income taxes or has financial transactions. TAN is required for any organization that deducts or collects tax at source. A TIN number is required by any dealer or... |

Tax Audit vs Statutory Audit

|

A tax audit is conducted to ensure that the financial statements of a person or an organization are in order. This may be done on the behalf of the person or company, or it may be a requirement. A statutory... |