Small Business

PAN Card vs AADHAR Card

|

PAN stands for Permanent Account Number. It is a number that is issued to any person who pays tax. Aadhar is an UID, i.e. a unique identification number. Its main purpose is to create a database of each... |

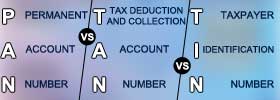

PAN vs TAN vs TIN

|

A PAN number is a number for anyone who pays income taxes or has financial transactions. TAN is required for any organization that deducts or collects tax at source. A TIN number is required by any dealer or... |

Commercial vs Personal Licenses

|

Commercial licenses are meant to be used by a company or corporation that is engage in commercial operations, whereas personal licenses are meant to be used by individual people who are engaged in personal... |

Market Research vs Marketing Research

|

Market research is a subset of marketing research. Marketing Research has a much larger scope as it deals with conducting research about the product, as well as consumer preferences; whereas, market research... |

Tax Invoice vs Retail Invoice

|

The main difference between the two is that a tax invoice is generated when a company sells a product to distributor or a person who plans on reselling the product. Whereas a retail invoice, is generated when... |