Difference between Forwards and Futures Derivatives

Key Difference: Forwards and futures are both forms of derivatives that are priced as per an underlying asset. However, forward contracts generally are private transactions, but futures are not.

A derivative means a formal agreement between two or more parties to buy or sell a particular asset. The price of a derivative directly hinges upon the price of the asset that is being dealt in. These assets could range from being bonds, commodities, currencies, interest rates, market indexes, stocks, etc. Derivatives are particularly used for speculating and hedging for profit, arising from the change in the price of a derivative’s asset over a period of time. Futures contracts, forward contracts, options, swaps and warrants are the different types of derivatives available. Derivatives are traded on the various national exchanges of countries, or as an OTC, i.e. over-the-counter derivative, which represents an individually negotiated contract between two parties.

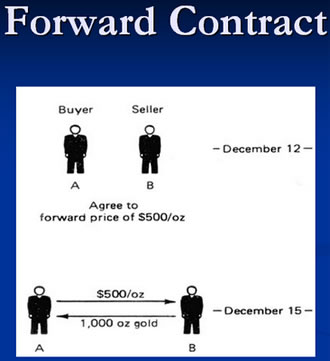

A forward contract is a tailor-made agreement between two parties to buy or sell an asset at a specified price, and on a future date. The settlement for such a contract is usually based on cash or delivery basis. Forward contracts are regarded as OTC instruments, as they are not regulated by any particular securities exchange. This actually makes forward contracts very viable for the purpose of hedging. However, they’re equally used for speculation purposes as well. Since forward contracts are not governed by centralized securities exchanges, they are associated with a high degree of risk.

Like forward contracts, futures contracts are also formal agreements prepared for the purpose of buying or selling a particular commodity at a pre-determined price in the future. These contracts too are settled on cash or a physical delivery basis. However, the salient points of difference between them is that futures contracts feature the quality and quantity of the underlying asset, and are more streamlined in nature as they are regulated and traded on the floors of a securities exchange.

Like forward contracts, futures contracts are also formal agreements prepared for the purpose of buying or selling a particular commodity at a pre-determined price in the future. These contracts too are settled on cash or a physical delivery basis. However, the salient points of difference between them is that futures contracts feature the quality and quantity of the underlying asset, and are more streamlined in nature as they are regulated and traded on the floors of a securities exchange.

Comparison between Forwards and Futures Derivatives:

|

|

Forward Derivatives |

Future Derivatives |

|

Nature of Transaction |

A forward contract is a private transaction. |

Futures contracts are reported to the futures exchange, the clearing house and at least one regulatory agency. |

|

Regulation/Governance |

Forward contracts are customized to meet the user's special needs. They are not regulated by any exchange and are individually negotiated. |

A future contract takes place on an organized exchange where all of the contract's terms and conditions, except price, are formalized. |

|

Risk |

Forward contracts are not governed by centralized securities exchanges, so they are associated with a high degree of risk. |

Futures do not involve risks because a clearing house guarantees against a default risk by taking both sides of the trade and marking to market their positions every night. |

|

Manipulation |

Forwards are basically unregulated, so they can be manipulated very easily. |

Manipulation is not easy in futures contracts as they are duly governed. |

Image Courtesy: futuresoptionsetc.com, futuresoptionsetc.com

Add new comment