Difference between Block and Bulk Deals

Key Difference: A block deal is a type of deal in which a minimum quantity of 5 lakh shares or shares with a minimum value of Rs. 5 crore are sold in a single trade. A bulk deal is a type of deal in which more than 0.5% of the number of equity shares of a company are bought or sold in the market in the same day.

Block and Bulk Deals are two different types of deals that can be conducted on the stock exchange. They are often conducted on both the National Stock Exchange of India Ltd. (NSE) and the Bombay Stock Exchange (BSE). The two different types of deals are ideal for companies or even people who trade in large numbers on the exchange. Both types of deals allow one to buy and sell in large numbers.

Block and Bulk Deals are two different types of deals that can be conducted on the stock exchange. They are often conducted on both the National Stock Exchange of India Ltd. (NSE) and the Bombay Stock Exchange (BSE). The two different types of deals are ideal for companies or even people who trade in large numbers on the exchange. Both types of deals allow one to buy and sell in large numbers.

A block deal is a type of deal in which a minimum quantity of 5 lakh shares or shares with a minimum value of Rs. 5 crore are sold in a single trade. The stock exchange allows for only a 35 minutes period in the beginning of the trading hours in which block deals can be traded, and they must be traded in a separate "Block Deal window" so as to not disrupt the market.

Additionally, they can only be traded between two parties who have predefined and negotiated the price, as one the block deal is listed it must be completed within 90 seconds, otherwise the deal is null and void. Also, the price of the deal cannot be more than +1% or less than -1% of the last traded price or the previous day’s closing price.

Also, in case a block deal does take place, the deal needs to be reported to the stock exchange, after which they are disclosed on the exchange’s website for all to see. This is to ensure that there is no backhand dealings in the trades, and that relevant persons know of the deal.

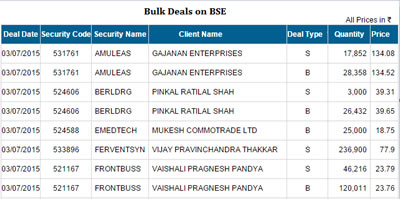

A bulk deal, on the other hand, is somewhat similar to a block deal in the sense that it also allows for buying or selling of larger number of stocks, however they work on slightly different premises. A bulk deal is a type of deal in which more than 0.5% of the number of equity shares of a company are bought or sold in the market in the same day. The deal need not be done in one single large deal but can be conducted in smaller pieces. However, if the total number of shares that are bought or sold exceed 0.5% of the security’s total, then it is considered as a bulk deal.

However, unlike a block deal, the price of a bulk deal need not be predetermined. Instead, it is market driven, i.e. a person can sell at any price they deem fit. They also occur in the regular window rather than in any special window. A bulk deal also needs to be notified to the exchange immediately upon the execution of the order. Alternately, if it occurs through multiple trades, it should be notified to the exchange within one hour from the closure of the trading.

However, unlike a block deal, the price of a bulk deal need not be predetermined. Instead, it is market driven, i.e. a person can sell at any price they deem fit. They also occur in the regular window rather than in any special window. A bulk deal also needs to be notified to the exchange immediately upon the execution of the order. Alternately, if it occurs through multiple trades, it should be notified to the exchange within one hour from the closure of the trading.

Both Block and Bulk Deals may have an impact on the market, especially on the prices of the shares that are bought and sold. However, most of the time there are no significant impacts, as they are mostly auto dealing. Still, if these deals take place regularly for a particular stock, it may indicate that the prices may rise.

Comparison between Block and Bulk Deals:

|

|

Block Deals |

Bulk Deals |

|

Type |

A type of deal wherein stocks are bought or sold on the stock market |

A type of deal wherein stocks are bought or sold on the stock market |

|

Shares |

Minimum quantity of 500,000 shares or a minimum value of Rs 5 crore |

More than 0.5% of the number of equity shares of a company listed on the stock exchange. |

|

Parties |

Predetermined Between two individual parties |

Market driven. Anybody can sell or buy on the market. Need not have a previous agreement. |

|

Process |

Shares are bought and sold on an agreed price |

Shares are bought and sold on listed price |

|

Markets |

BSE and NSE |

BSE and NSE |

|

Timings |

Only during the first 35 minutes of the trading period, i.e. from 9:15 am to 9:50 am. |

Throughout the trading period, i.e. no specific time. |

|

Price |

Price range should not exceed +1% to -1% of the last traded price or the previous day’s closing price |

No fixed or specific price range |

Reference: India Infoline, Economic Times, Sana Securities, LiveMint Image Courtesy: sanasecurities.com

Add new comment