Difference between Travellers Check and Travel Card

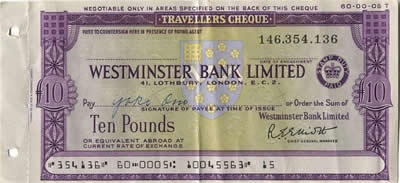

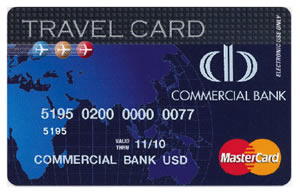

Key Difference: Travelers check are pre-paid pieces of paper that have currency stamped on them. These currencies were in numbers such as 20, 50, 100, etc. and can be used as a normal currency. Prepaid Forex Card work as credit cards or debit cards and they even look the part. Small 3.5” cards that can be loaded with any currency and sometimes with multiple currencies.

The biggest concern of a person when travelling abroad is currency. Carrying around a wad of cash is never considered a good option – so companies have come up with better ones. Travellers Checks and Travel Card are two different types of current options that people can use when they are travelling.

The biggest concern of a person when travelling abroad is currency. Carrying around a wad of cash is never considered a good option – so companies have come up with better ones. Travellers Checks and Travel Card are two different types of current options that people can use when they are travelling.

Before the start of 2000s, travelers check was a very popular from of foreign currency one could get their hands on before travelling abroad. These days they are a dying breed. For many people who are not familiar with these, travelers check are pre-paid pieces of paper that had currency stamped on them. These currencies were in numbers such as 20, 50, 100, etc. They were often issued in the home currency or a popular currency such as US dollars, UK pounds or Euros. The issuer would sign each note when the check was issued. He would then sign again when giving the check to a merchant as a form of payment.

There was one problem though – checks were expensive. A person travelling from US would issuethe checks in USD, but if he travelled to, let’s say, China. He would have to convert the checks in Yen. He could still pay for things with the traveler checks but the place where he would give the check will convert the currency for him at a very low rate. This would result in the issuer paying more than he would if he would carry currency. However, travelers check do have their own benefits – in case they are stolen or lost, they can be replaced at no cost. Additionally, it doesn’t require an ATM or other computer based technologies.

With the passing of the travellers checks and plastic taking over paper, many banks have now started promoting cards as a form of foreign currency. The newest trend is known as Prepaid Forex Card that work as credit cards or debit cards and they even look the part. Small 3.5” cards that can be loaded with any currency and sometimes with multiple currencies.The currency is often exchanged at a fixed rate when they are loaded with a small issuance fee for the card and a reload rate. The card has a limit of how much money is loaded on the card, after which more can be loaded at the then exchange rate.

With the passing of the travellers checks and plastic taking over paper, many banks have now started promoting cards as a form of foreign currency. The newest trend is known as Prepaid Forex Card that work as credit cards or debit cards and they even look the part. Small 3.5” cards that can be loaded with any currency and sometimes with multiple currencies.The currency is often exchanged at a fixed rate when they are loaded with a small issuance fee for the card and a reload rate. The card has a limit of how much money is loaded on the card, after which more can be loaded at the then exchange rate.

These cards can then be used at ATMs to withdraw cash, with a small fee of course. They can also be swiped at outlets and any places similar to a credit card or a debit card. There is no per transaction charge, so the issuer won’t be charged at every transaction. The card also comes with PIN facilities that make the card more secure. At the end of the trip, any extra money left on the card can be saved for a future trip or converted back to the home currency.

With many places allowing cards, there are only few places that a person would require paper cash. This makes the prepaid travel cards a more feasible option, as well a beneficial one. The card would also allow the person to refrain from carrying a wad of papers that can be easily stolen.

Comparison between Travellers Check and Travel Card:

|

|

Travellers Check |

Travel Card |

|

Encashing |

Travellers Checks can be encashed at banks, travelling agencies or the place that issued the check. However, now many places have stopped encashing these checks |

Travel Cards do not require any enchasing but money can we withdrawn from any ATM |

|

Foreign Exchange Rate |

High exchange rate compared to currency |

Lower or equal exchange rate compared to currency |

|

Safety |

Is a safer option compared to carrying currency as it requires the person’s signature to enchash it |

Is a safer option compared to any other form of currency as it works like a credit card, requiring a pin for issuing money |

|

Fees |

A 1% to 4% charge is levied as commission by the business accepting it. The bank where the check is issued may also charge a small fee to issue the checks. |

A modest issuance fee is charged when the card is issued. When issuing money from the ATM, a small amount is charged for per transaction A small amount is also charged in order to reload the card with more currency |

|

Replacement |

Free of charge replacement, if the issuer remembers the serial numbers of the checks that were stolen or lost |

A small amount is charged in order to issue another card |

|

Advantage |

Free replacement if checks are lost or stolen A more secure way to carry currency as the check require signatures in order for the check to be cashed Not dependent on computer |

A safer way to carry currency as it requires pin and signature for the money to be issued Can be used as a credit card and punched at various shopping places Pre-paid so one does not have to constantly worry about fluctuating rate of exchange |

|

Disadvantage |

A list of check numbers have to be noted including each check that is spent These days many places do not accept travelers check Horrible exchange rates |

Requires an ATM in order to issue cash Requires a credit or a debit machine for it to be used Charges fees for withdrawing cash from the ATM or reloading more cash in to the card |

Image Courtesy: strawberrywalrus.com, suggestkeyword.com

Add new comment