Difference between EPO and PPO

Key Difference: EPO and PPO are essentially two different types of healthcare insurances. EPO stands for Exclusive provider organizations, while PPOs are Preferred provider organizations. PPOs cover care provided both inside and outside the plan’s provider network. EPOs only cover care provided by the provider network.

EPO and PPO are essentially two different types of healthcare insurances. In the United States, the cost of healthcare is sky high. Hence, affording healthcare is a difficult task for most citizens. This is where a health insurance helps out.

EPO and PPO are essentially two different types of healthcare insurances. In the United States, the cost of healthcare is sky high. Hence, affording healthcare is a difficult task for most citizens. This is where a health insurance helps out.

A health insurance is a type of insurance that protects against the risk of having to pay medical bills. In health insurance, the insured pays a premium every year, in return of which the insurance company pays the medical bills of the insured, if and when they may occur under the covered period.

However, these health insurances, like all other insurances, are subject to certain terms and conditions. For example, the insurance may cover only certain types of illnesses, certain types of healthcare provided, or certain hospitals. Also, the insurance company may pay all the medical bills in full, or may pay only part of the amount owed.

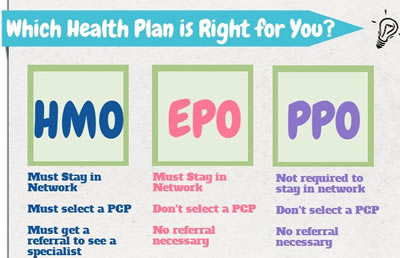

There are four main types of health insurance available to the public: HMOs, PPOs, EPOs and POS. HMOs are Health maintenance organizations, PPOs are Preferred provider organizations, EPO stands for Exclusive provider organizations, while POS are Point of Service plans.

Depending on the company, there may be vast differences between each of the plans, or practically none at all. The main reason for this is that fact that there are no industry-wide definitions of plan types, and that state standards vary. Hence, the same plan may be completely different depending on where the insured lives, or two plans sold under different names may be exactly the same. This is why it is always advisable to compare plans before purchasing.

Preferred provider organizations (PPOs) cover care provided both inside and outside the plan’s provider network. The provider network is an organization of hospitals, doctors, and other health care providers that have agreed with an insurer or a third-party administrator to provide health care at reduced rates to the insurer's or administrator's clients. Under this plan, the insured can visit any doctor, irrespective of whether or not they are part of the provider network. However, most insurers charge a higher percentage of the cost for out-of-network care.

Exclusive provider organizations (EPOs), on the other hand, only cover care provided by doctors and hospitals inside the provider network. They generally don’t cover care provided by doctors and hospitals outside the plan’s provider network. This can be a problem in an emergency, when the insured cannot get to a hospital covered under their plan.

However, as there are no industry regulations defining these definitions, there are instances where these differences are not true. There are some plans that are labeled as PPOs, but they do not offer out-of-network services at all. On the other hand, some EPOs may offer an out-of-network option, usually at a higher co-pay, which might make them similar to PPOs.

Comparison between EPO and PPO:

|

|

EPO |

PPO |

|

Stands for |

Exclusive provider organizations |

Preferred provider organizations |

|

Type of |

Health care insurance |

Health care insurance |

|

Services Covered |

Most EPO plans cover basic medical treatment, preventative care, emergencies, and long-term and specialist treatment such as surgeries and physical therapy. |

Most PPO plans cover basic medical treatment, preventative care, emergencies, and long-term and specialist treatment such as surgeries and physical therapy. |

|

Insurance Premium |

Might be lower than that of the PPO. |

Might be higher than that of the EPO |

|

Primary care physician |

Does not require a primary care physician. |

Does not require a primary care physician. |

|

Out of network coverage |

Generally don’t cover care outside the plan’s provider network, except in emergency or urgent care situations. |

Cover care provided both inside and outside the plan’s provider network. |

|

Referral |

May not need a referral to see a specialist. |

May not need a referral to see a specialist. |

|

Pre-authorization |

Requires pre-authorization for certain types of healthcare services, such as surgery or hospital visits. |

Requires pre-authorization for certain types of healthcare services, such as surgery or hospital visits. |

|

Cost-sharing |

Low cost-sharing |

High cost-sharing, especially for out-of-network care |

|

Claim |

Do not have to file claim paperwork. |

Have to file claim paperwork but only for out-of-network claims. |

Image Courtesy: aegonreligare.com, medicoverage.com

Add new comment